USDA estimated the 2020/21 US soybean ending stock to come in at 11.02 million MT, lower by 730,000 MT than its earlier estimate of 11.75 million MT. For the past three years, ending stock were pegged at 15.79 million MT in the marketing year of 2019/20, 24.74 million MT (2018/19) and 11.92 million MT (2017/18). Meanwhile, global soybean ending stock for the period of 2020/21 is forecast to be at a five-year low of 98.39 million MT which is lower than the earlier estimated amount of 103.5 million MT (USDA). With a significant tightening of US and global soybean ending stocks for the 2020/21 season, November soybean futures is forecast to be bullish at around $9.18 per bushel.

Additionally, news on large soybean purchase by China also contributed as a booster to soybean prices. The robust demand from Chinese crushers is to cover their COVID-19 related supply-side uncertainties. A Chinese agency estimated the country’s 2020/21 soybean import to be around 93.6 million MT, which would be a nearly 3% increase over the previous season (Agriculture.com). Chinese import demand for US soybean is likely to stay comparatively low for the month of April-June 2020 because preference has been given to Brazilian soybean. Soybean from Brazil have gained additional price advantage over its main competitor; US soybean, due to low Brazilian real currency combined with good harvest pace. Almost 75% of Brazilian soy shipments had been destined for China in the first four months of 2020 (S&P Global).

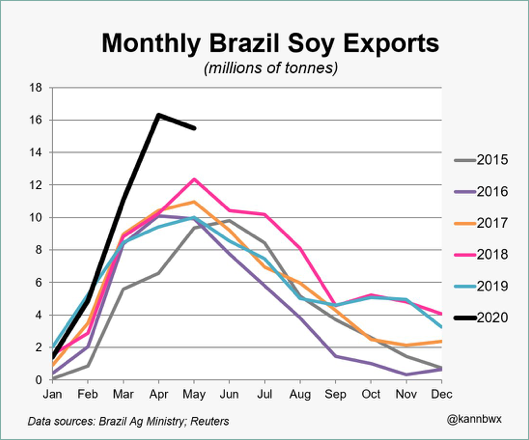

Another factor favoring Brazilian soybean farmers is the timing of exports. Brazilian soybean sales peak between February and May, ahead of the US soybean harvest and export season around September to December. For January to May 2020, Brazil exported 49.2 million MT of soybeans, an increase of 40% compared to Jan-May 2019 period (Graph 1). From that amount, about 15.5 million MT was exported in the month of May and 16.3 million MT was exported in April , according to AgRural. Brazil is expected to export a total of 72 million MT in 2019-2020 local marketing year, up 3% from the previous year, according to CONAB national crop agency. As soybean prices is boosted by tight ending stocks, soybean oil prices will climb up and will make palm oil a more attractive option. Palm oil is affected by price movements of other vegetable oils as they compete for a share in the global market. Vegetable oil prices are linked across the globe where higher soybean prices will widen the gap between soybean oil and other vegetable oils.

Graph 1: Soybean Export by Brazil (million MT)

Sources :

- USDA, May 2020.

- Agriculture.com. https://www.agriculture.com/markets/analysis/tight-soybean-ending-stocks-offers-a-buying-opportunity-analyst-says

- S&P Global

- AgRural

- CONAB

- Brazil Ag Ministry

- Reuters

Prepare by Nur Adibah Mohd Razali

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.